Smart Budgeting Strategies for 2025: Save More Without Sacrificing Lifestyle

Smart Budgeting Strategies for 2025: Save More Without Sacrificing Lifestyle

Learn smart budgeting strategies for 2025 that help you save more without giving up the lifestyle you love. Practical tips, modern tools & real examples inside.

📑 Table of Contents

- Introduction: Why Budgeting Needs a 2025 Upgrade

- The Shift to Lifestyle-Conscious Budgeting

- Strategy 1: The 70/20/10 Budget Rule for the Modern World

- Strategy 2: AI-Driven Budgeting Apps That Work for You

- Strategy 3: Automate Your Financial Life

- Strategy 4: Cut the Waste, Not the Joy

- Strategy 5: Smart Investments as a Budgeting Tool

- Real-Life Case Study: Lifestyle + Savings = Win-Win

- Mistakes to Avoid in 2025 Budgeting

- Conclusion: Budget Smarter, Live Better

- 🌐 Internal & External Links

1. 📌 Introduction: Why Budgeting Needs a 2025 Upgrade

In 2025, managing money is not just about cutting costs—it’s about managing value. Inflation, lifestyle inflation, rising housing and food prices, and subscription overloads have made old-school budgeting techniques feel outdated. To truly succeed in 2025, your budgeting approach must be flexible, tech-savvy, and lifestyle-friendly.

The goal? Save more, but still enjoy your daily life.

2. 🌿 The Shift to Lifestyle-Conscious Budgeting

Gone are the days when budgeting meant saying no to coffee dates or travel. Today’s budgeting is about smart prioritization. You don’t need to cut joy—you need to cut waste.

People now want budgets that:

- Let them travel once a year

- Pay for Netflix, Gym, and Spotify without guilt

- Still allow regular savings and investments

Welcome to lifestyle-conscious budgeting—a smarter, modern way to balance joy and savings.

3. 💡 Strategy 1: The 70/20/10 Budget Rule for the Modern World

Forget the old 50/30/20 rule. In 2025, a 70/20/10 model fits better:

- 70% Needs + Lifestyle (Rent, food, entertainment, subscriptions)

- 20% Future Self (Savings, SIPs, investments)

- 10% Freedom Fund (Guilt-free splurges, travel, gadgets)

Why it works:

- Combines essential and joy expenses

- Prioritizes future planning

- Builds a “don’t-feel-bad” budget for fun spending

👉 Pro Tip: Track your monthly expenses using tools like Moneyfy or YNAB (You Need a Budget).

4. 🤖 Strategy 2: AI-Driven Budgeting Apps That Work for You

In 2025, budgeting without tech is like walking without Google Maps. AI apps can help:

🔧 Tools to Try:

- Mint (Global) – tracks and categorizes your spending

- Walnut (India) – links to SMS & bank accounts for smart insights

- Money View – gives credit score, loan tracking & budget advice

- GoodBudget – helps with envelope budgeting, digitally

These apps analyze spending habits, give real-time alerts, and even create forecasts.

5. 🔁 Strategy 3: Automate Your Financial Life

Automation is your secret weapon in 2025. Automate:

- SIPs (Systematic Investment Plans)

- Recurring deposits

- Credit card bill payments

- Utility bills

- Emergency fund contributions

You reduce decision fatigue, avoid late fees, and stay consistent with savings.

6. ✂️ Strategy 4: Cut the Waste, Not the Joy

Small leaks sink big ships. Identify and plug financial leaks:

- Unused gym memberships

- Forgotten subscriptions

- Impulse online shopping

- Daily food deliveries

Instead, batch spending:

- Cook in bulk

- Limit delivery apps to weekends

- Share OTT plans with family

This helps you cut unnecessary spend while still enjoying life.

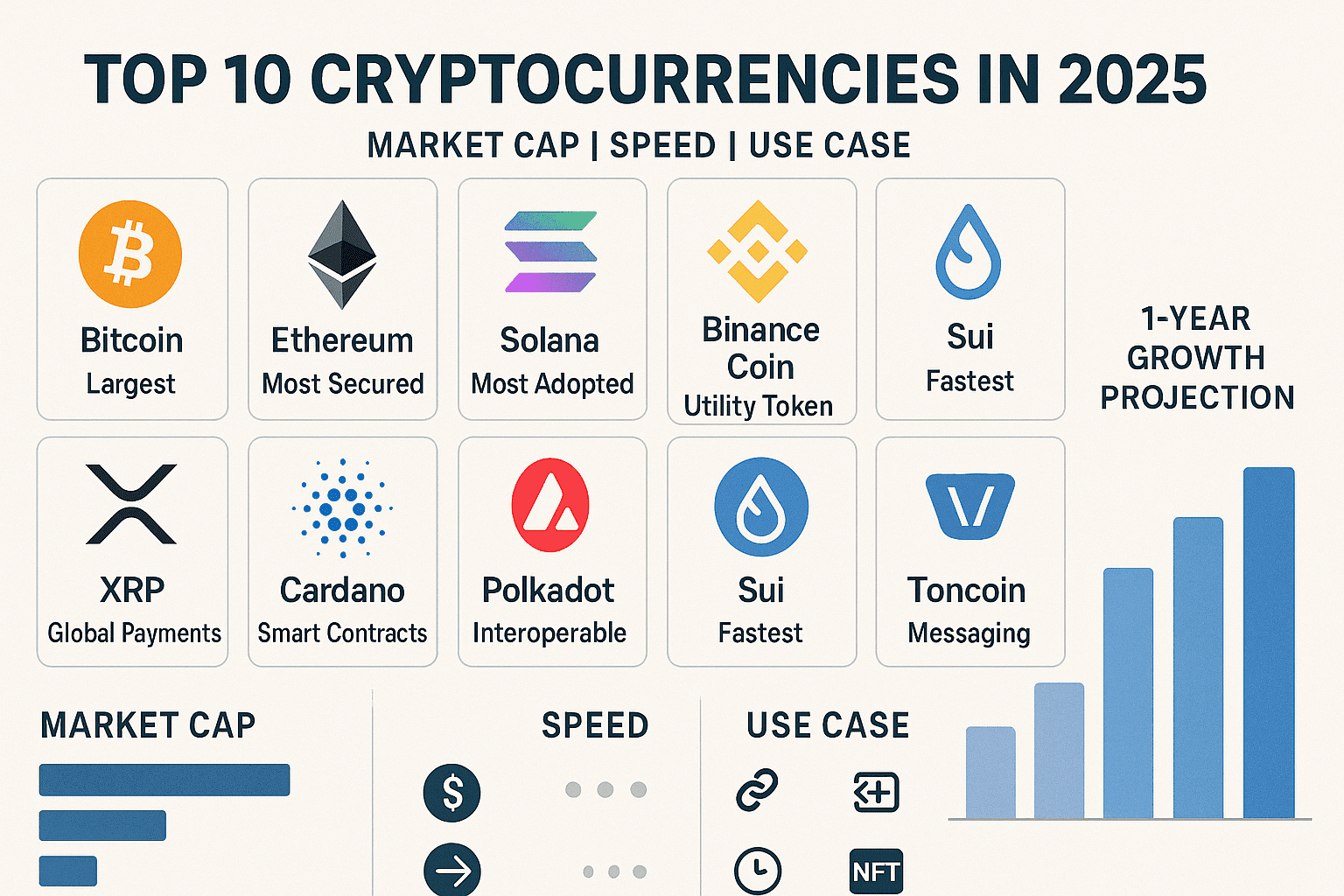

7. 📈 Strategy 5: Smart Investments as a Budgeting Tool

In 2025, budgeting isn’t just about saving—it’s also about growing money. Use investment to support your budget:

- SIPs in index funds (Nifty 50, S&P 500)

- FD ladders for secure growth

- Digital gold or REITs for diversification

- Mutual funds with low TER (Expense Ratio)

Returns from these can be reinvested or used to support lifestyle upgrades like travel, gadgets, etc.

8. 🧑💼 Real-Life Case Study: Lifestyle + Savings = Win-Win

Case: Ananya, 28, Digital Marketer from Delhi

Before: Living paycheck-to-paycheck, minimal savings

After: Switched to 70/20/10 rule, automated SIPs, canceled 3 unused subscriptions

Results in 6 months:

- Saved ₹1.2 lakhs

- Took a Goa trip fully from interest earned

- Built a ₹50k emergency fund

This shows you can enjoy life and still grow your money with smart budgeting.

9. ❌ Mistakes to Avoid in 2025 Budgeting

- Ignoring inflation while planning

- Relying only on bank savings

- Budgeting without tracking apps

- Not setting financial goals

- Over-optimizing and burning out

The goal isn’t perfection—it’s consistency.

10. ✅ Conclusion: Budget Smarter, Live Better

Smart budgeting in 2025 is less about restriction and more about intention. By using tech, planning smarter, and focusing on lifestyle-conscious strategies, you can save more without sacrificing what makes life enjoyable.

You deserve a life where money works for you—not the other way around.

3 Comments