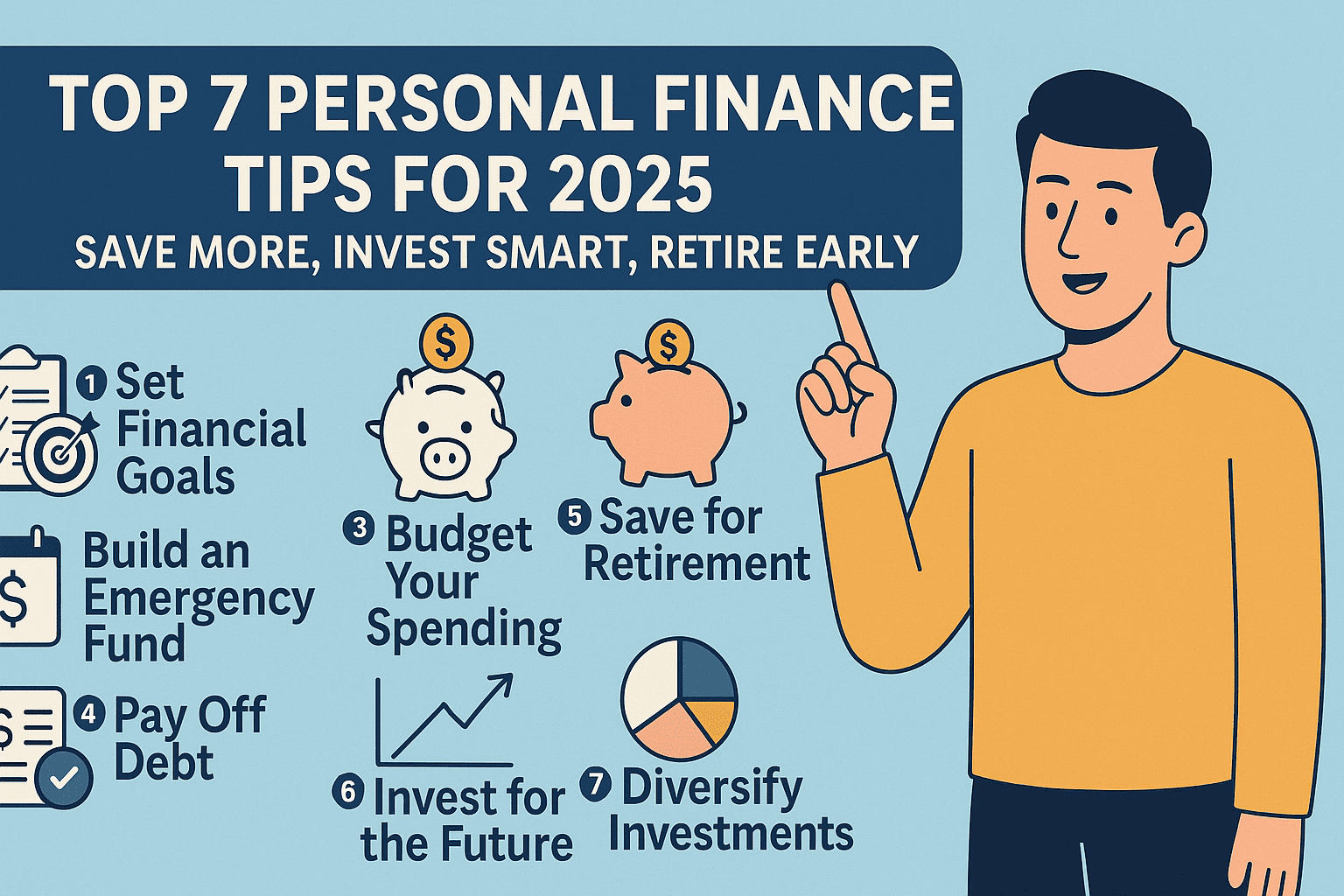

Top 7 Personal Finance Tips for 2025: Save More, Invest Smart, Retire Early

Top 7 Personal Finance Tips for 2025: Save More, Invest Smart, Retire Early

Discover the top 7 personal finance tips for 2025 that will help you save more, invest smartly, and build wealth for early retirement. Must-read for Indians and global readers!

📑 Table of Contents

- Track Every Rupee & Dollar You Spend

- Create a Smart Budget & Stick to It

- Start Investing Early with Low-Risk Options

- Master Credit Card Usage & Avoid Debt Traps

- Build a Strong Emergency Fund

- Use Finance Apps to Automate Savings

- Set Clear Financial Goals for the Year

- Final Thoughts

1. 🧾 Track Every Rupee & Dollar You Spend

One of the most effective personal finance tips in 2025 is tracking your expenses daily. With inflation hitting essentials globally, it’s critical to know where every rupee or dollar goes.

✅ Tools to use:

- Walnut (India)

- Mint (Global)

- Money Manager (manual entry lovers)

- Google Sheets

Pro Tip: Review your expense categories weekly. Cut small unnecessary spending like unused subscriptions or impulsive snacks.

2. 📊 Create a Smart Budget & Stick to It

Budgeting is freedom with structure, not restriction.

Use the 50/30/20 Rule:

- 50% Needs: Rent, groceries, transport

- 30% Wants: Netflix, restaurants, shopping

- 20% Savings/Investments

📌 Bonus Strategy: Try Zero-Based Budgeting—assign every rupee a role, including savings.

🚫 Don’t forget: Budget for quarterly or annual expenses (like car insurance or health checkups).

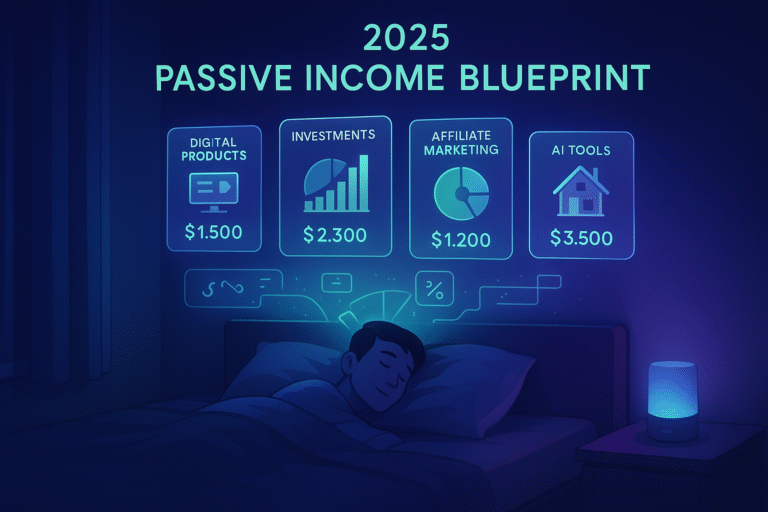

3. 💰 Start Investing Early with Low-Risk Options

2025 offers beginners an amazing variety of low-risk investment tools:

- Index Funds (Nifty 50, S&P 500)

- Public Provident Fund (PPF)

- Recurring Deposits (RDs)

- Global ETFs (Groww, INDmoney)

📈 Why it works: Compound interest is magic. Start investing even ₹5000/month and watch it grow.

🧠 Case Study: Rahul, 24, invested ₹5000/month since 2020. By 2025, he had over ₹3.5 lakhs + returns.

4. 💳 Master Credit Card Usage & Avoid Debt Traps

Used wisely, credit cards can boost your score and give rewards.

✅ Best Practices:

- Pay full balance monthly (never just minimum due)

- Keep utilization under 30%

- Use apps like CRED to track due dates and get rewards

Pro Tip: Use a dedicated card for auto-bill payments and track rewards.

🚫 Avoid carrying a balance — interest rates are brutal.

5. 🚨 Build a Strong Emergency Fund

Life throws curveballs. Prepare a fund covering 3–6 months of expenses.

🏦 Where to store it?

- Airtel Payments Bank (India)

- Marcus by Goldman Sachs (Global)

- Liquid Mutual Funds or IDFC First Bank

💼 Pro Tip: Use a separate account labeled “Emergency Fund” so you never touch it for casual spending.

6. 📱 Use Finance Apps to Automate Savings

2025 is the year of automation. Use smart apps to remove friction from saving.

🔥 Best Apps:

- INDmoney – Tracks investments, net worth

- ET Money – Mutual funds, SIPs, insurance

- YNAB – Global budgeting solution

🎯 Benefits:

- Auto-debits help you save first, spend later

- Goal-based tracking keeps you focused

- Real-time insights improve discipline

📸 Image Suggestion: INDmoney dashboard with SIP tracking

Alt Text: INDmoney dashboard showing automated savings in 2025

7. 🎯 Set Clear Financial Goals for the Year

Without goals, money just disappears.

Set SMART Goals:

- Specific (e.g., Save ₹1.2 lakh for a new laptop)

- Measurable (e.g., ₹10,000/month SIP)

- Achievable & Realistic (based on income)

- Time-bound (e.g., by December 2025)

📋 Tools: Google Sheets, Notion, GoodBudget

💡 Goal Ideas:

- Clear credit card debt

- Save ₹2 lakhs for a trip

- Start a ₹15,000/month SIP

📸 Image Suggestion: Google Sheets goal planner

Alt Text: Google Sheets template for setting personal finance goals

8. 🚀 Final Thoughts: Build Financial Freedom in 2025

If you implement even 3 out of these 7 tips, you’ll already be ahead of most.

💡 Remember:

- Track → Budget → Save → Invest

- Start small but stay consistent

- Financial freedom is possible at any income level if you’re disciplined

👊 Let 2025 be your best year financially!

5 Comments