Crypto Tax Rules 2025: A Global Guide to Regulations & Investor Compliance

Crypto Regulation in 2025: What Indian and Global Investors Need to Know

Curious about crypto regulation in 2025? This guide explains the latest crypto laws in India and worldwide, tax rules, compliance tips, and what investors need to stay legal and secure.

Discover the latest crypto tax rules in 2025 for India, the US, UK, and more. Learn how different countries regulate crypto, what taxes apply, and how to stay compliant as an investor or trader.

🪙 Introduction:

Crypto regulation has been one of the biggest question marks for investors and traders. In 2025, the landscape is clearer—but still complex. If you’re in India or trading globally, you need to know what’s legal, what’s taxed, and what’s coming next. This blog breaks it all down so you can invest confidently and stay compliant.

🇮🇳 Crypto Regulation in India – 2025 Overview

✅ Is Crypto Legal in India in 2025?

Yes—but with strict rules. The Indian government has not banned crypto, but it has:

- Imposed heavy taxation

- Regulated it under financial compliance laws

- Launched plans for a central bank digital currency (CBDC)

🏛️ Key Indian Authorities:

- RBI (Reserve Bank of India): Oversees digital financial stability

- CBDT (Income Tax Department): Handles crypto taxation

- FIU-IND: Monitors exchanges for AML compliance

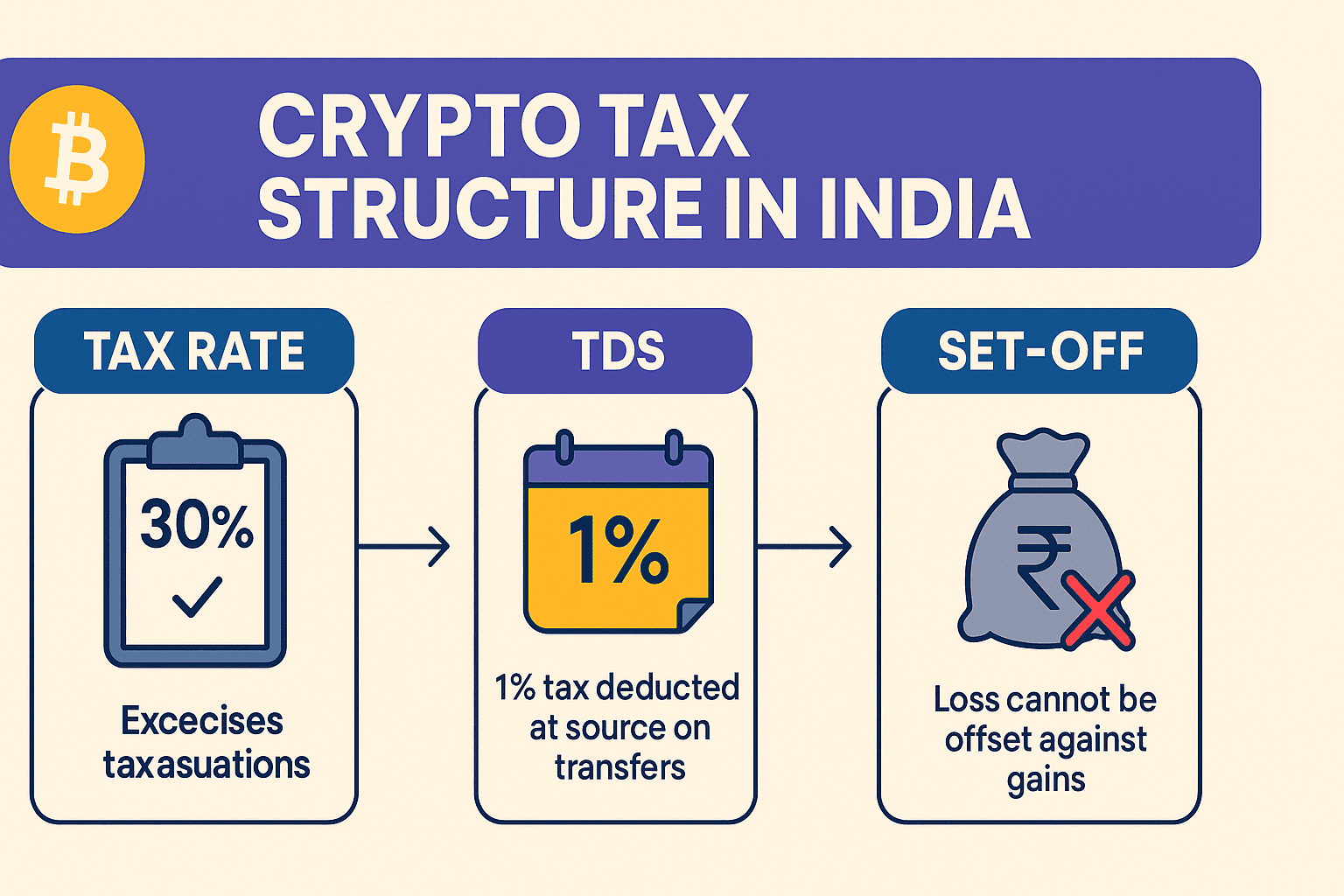

💸 India’s Crypto Tax Rules in 2025:

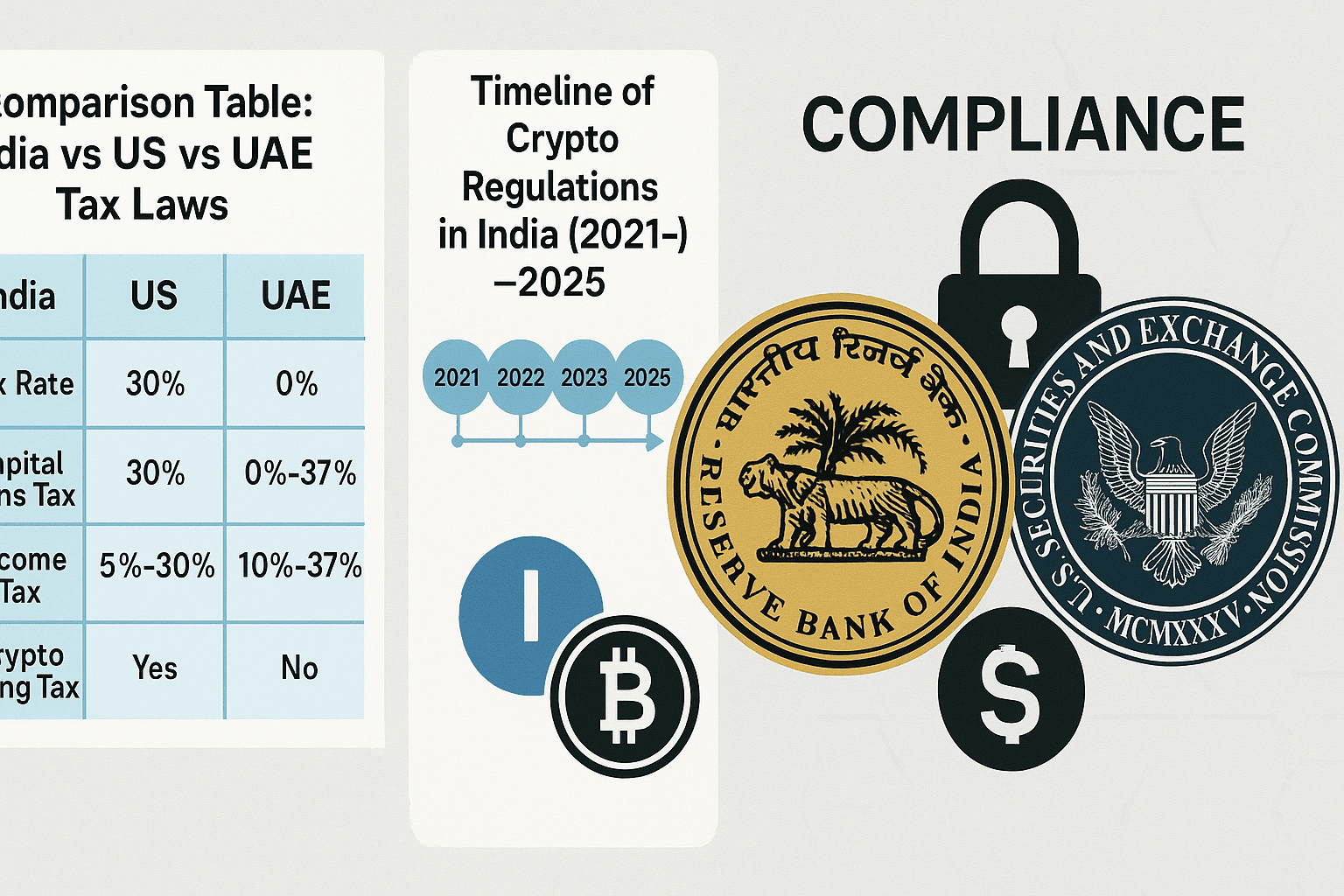

| Category | Rule |

|---|---|

| Capital Gains | 30% flat tax on profits |

| TDS | 1% on all transactions above ₹50,000 |

| Loss Offset | Not allowed against any other income |

| Airdrops/Rewards | Taxed as “Other Income” |

| NFTs | Taxed similar to crypto |

🔍 Pro Tip: Use tools like KoinX or ClearTax Crypto to automate tax filing

🧾 How to Stay Compliant in India:

- Complete full KYC on registered exchanges like WazirX, CoinDCX

- Report crypto income in your ITR under Schedule VDA

- Maintain records of all trades and wallet addresses

- Use PAN-Aadhaar linked accounts to avoid scrutiny

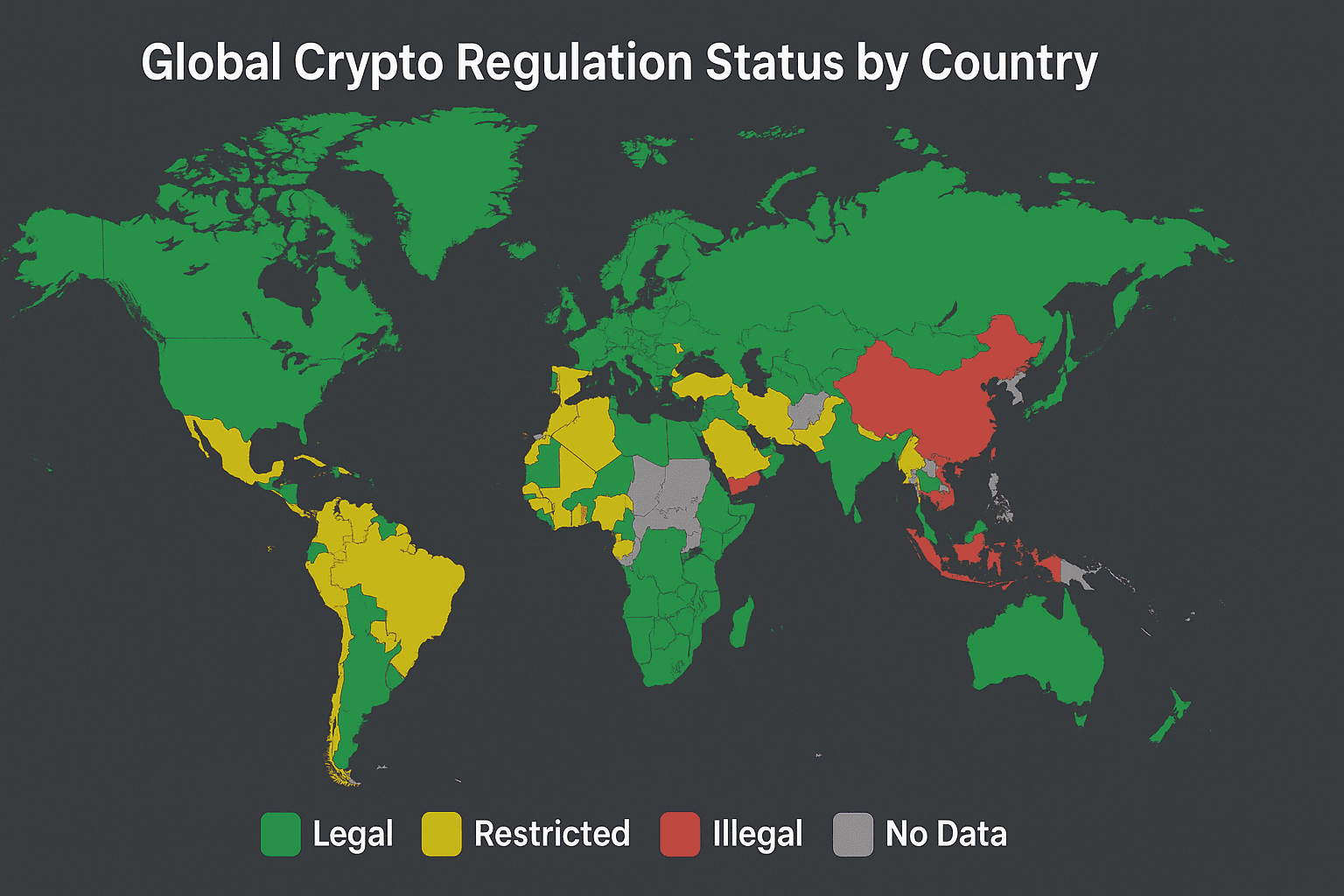

🌍 Global Crypto Regulations in 2025

🇺🇸 United States:

- SEC treats most altcoins as securities

- Taxed as property—short-term and long-term capital gains

- Heavy compliance via platforms like Coinbase, Kraken

- New developments: Stablecoin regulation, ETF approvals

🇪🇺 European Union:

- Introduced MiCA Regulation in 2024—fully in effect now

- Clear licensing rules for crypto service providers

- User protection and anti-money laundering (AML) focused

🇦🇪 UAE (Dubai):

- Tax-free crypto zones

- Strong support for blockchain startups

- Ideal for international crypto entrepreneurs

🇸🇬 Singapore:

- Regulated under MAS

- Crypto exchanges need licenses

- Popular for fintech innovation

🏦 Are Indian Crypto Exchanges Regulated?

Yes, partially. Exchanges like:

…are registered with FIU-IND and follow KYC + AML compliance. However, they are not RBI-regulated banks, so they function under different frameworks than traditional financial institutions.

🧠 What to Expect Next (Predictions for 2025 & Beyond)

- CBDCs will expand – India’s Digital Rupee may be integrated into UPI

- Stablecoin rules – USDT, USDC may face tighter scrutiny

- Crypto ETFs – More institutional investment through regulated vehicles

- Global cooperation – Countries will align on anti-money laundering standards

- India’s Crypto Bill – Still pending, but expected to create a full legal framework

💥 The Risks of Not Following Regulation

If you don’t follow the rules, here’s what can happen:

- ✅ Account freezes

- ✅ Penalties or fines

- ✅ ITR mismatch notices from the Income Tax Dept

- ✅ Blacklist from exchanges or FIU radar

🛡️ Pro Tip: Always use official exchanges and avoid unlicensed P2P or foreign platforms without compliance.

🔗 Internal Links:

✅ Conclusion:

Crypto regulation in 2025 is finally moving toward clarity and accountability. For Indian and global investors, this is a positive sign—it means the industry is maturing. As long as you stay informed, file taxes properly, and use trusted platforms, you can legally and safely build your crypto portfolio in this new era of digital finance.