Crypto vs Stock Market in 2025: 7 Key Differences You Must Know

Crypto vs Stock Market in 2025: 7 Key Differences You Must Know

Investors in 2025 have more choices than ever before. One of the hottest debates right now is: Crypto vs Stock Market in 2025 – where should you put your money?

In this easy-to-understand guide, we’ll compare both options and highlight 7 major differences to help you make smarter investment decisions. Whether you’re a beginner or a seasoned investor, this blog will give you a fresh perspective on where your money might grow the most.

🔍 Table of Contents

- Introduction

- Volatility: Crypto vs Stock Market in 2025

- Regulation and Safety in Crypto vs Stock Market 2025

- Accessibility in Crypto vs Stock Market in 2025

- Returns and Risk Comparison: Crypto vs Stock Market 2025

- Liquidity and Trading Hours: 2025 Market Differences

- Long-Term Growth: Crypto vs Stock Market 2025

- Which One Should You Pick?

- Summary

1. Introduction: What Changed in 2025?

The world of investing has evolved rapidly. In 2025, both the crypto space and the stock market are more accessible, more transparent, and more competitive. Traditional markets have embraced technology, while cryptocurrencies are pushing the boundaries of decentralized finance (DeFi) and tokenized assets.

Many investors are now split between old-school reliability and new-age innovation. The big question remains:

“Is crypto better than stocks, or are stocks still the smart choice?”

Let’s explore how they compare in today’s landscape.

2. Volatility: Crypto vs Stock Market in 2025

📈 Crypto

Cryptocurrencies like Bitcoin, Ethereum, and Solana are known for dramatic price swings. In 2025, even with greater adoption and institutional interest, crypto remains volatile. Price jumps or crashes of 10–20% within hours are still common. Influences include global regulation, tech adoption, investor sentiment, and social media trends.

📉 Stocks

Stocks are generally more stable and respond predictably to earnings, news, and economic data. While tech stocks may be more volatile than blue-chip companies, overall, stock market movements are easier to understand and anticipate.

3. Regulation and Safety in Crypto vs Stock Market 2025

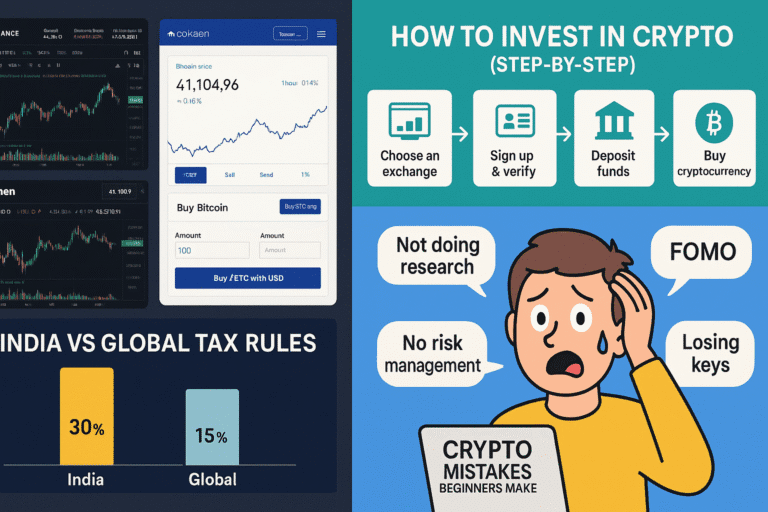

🔒 Crypto

Crypto regulation in 2025 has come a long way, with governments implementing KYC/AML policies and licensing exchanges. However, there are still unregulated tokens and risks of scams, hacks, and rug pulls.

🔢 Stocks

Stocks are backed by strong regulatory systems like the SEC (USA) and SEBI (India). These bodies ensure transparency, investor protection, and corporate accountability. Fraud is rare and often punished strictly, offering investors peace of mind.

4. Accessibility in Crypto vs Stock Market in 2025

🌐 Crypto

Anyone with a smartphone and internet can invest in crypto within minutes. Global platforms like Binance, Coinbase, and WazirX offer 24/7 access. Crypto is inclusive—even those without bank accounts can join the market using digital wallets.

💼 Stocks

To invest in stocks, you need a Demat and trading account. Most brokerage apps are user-friendly, but require KYC verification. Also, stock exchanges have limited trading hours.

External Resource: Visit Binance (DoFollow)

5. Returns and Risk Comparison: Crypto vs Stock Market 2025

⚡ Crypto

Crypto can bring explosive growth, but it’s risky. Bitcoin more than doubled from 2023 to 2025. However, many altcoins lost 70–90% of their value before recovering. It’s a high-stakes game that rewards those who can time the market—or hold for the long run.

📅 Stocks

The stock market has a long history of generating consistent returns. The S&P 500, Sensex, and Nifty 50 have offered 8–12% annual returns on average. Dividends and compound growth make stocks a safer choice for long-term wealth building.

6. Liquidity and Trading Hours: 2025 Market Differences

🌐 Crypto

Crypto markets are open 24/7, 365 days a year. This makes them accessible any time of day, ideal for global investors and night owls alike. You can buy or sell Bitcoin on a Sunday at 2 AM with no delays.

📆 Stocks

Stock markets operate during business hours on weekdays. Indian markets, for example, are open from 9:15 AM to 3:30 PM. After-hours trading is limited and often illiquid.

7. Long-Term Growth: Crypto vs Stock Market 2025

🚀 Crypto

Crypto projects are building the future of finance, gaming, and the internet (Web3). Ethereum’s shift to proof-of-stake and real-world use cases in DeFi are just the beginning. Still, regulation and adoption pace will shape its future.

📈 Stocks

Stocks remain a core asset in any portfolio. Companies evolve, merge, and innovate. Giants like Apple, Microsoft, and Reliance have shown how patient investors can build wealth over time. Stocks also offer dividends and voting rights—something crypto usually doesn’t.

🧠 Which One Should You Pick?

There’s no clear winner. Instead, the choice depends on your investment goals:

- Choose crypto if you’re tech-savvy, can handle risk, and want higher returns.

- Choose stocks if you value safety, steady returns, and proven performance.

- Best strategy: Diversify. Combine both assets to spread your risk.

A balanced portfolio might include 70% in stocks and 30% in crypto for moderate-risk investors. Younger, high-risk investors might flip that ratio.

Internal Link Suggestion: [How to Build a Balanced Portfolio in 2025]

📄 Summary

- Crypto = high-risk, high-reward, 24/7 market, innovative

- Stocks = low-risk, stable, historically strong, dividend-earning

In 2025, both crypto and stocks offer valuable opportunities. Your personal goals, risk tolerance, and time horizon should guide your decision. As always, invest wisely and never put in more than you can afford to lose.

Stay tuned for more expert insights on smart investing in 2025!