How to Build a Emergency Fund in 2025: Your Safety Net Against Life’s Surprises

How to Build an Emergency Fund and Secure Your Financial Future in 2025: Your Safety Net Against Life’s Surprises

Discover practical strategies to safeguard your finances in 2025. Learn how to prepare for unexpected expenses and navigate uncertainty with confidence—no matter your income.

Establishing an Emergency Fund is crucial to safeguard your finances in 2025. Learn how to prepare for unexpected expenses and navigate uncertainty with confidence—no matter your income.

📌 Table of Contents :

- What’s a Financial Safety Net & Why You Need It in 2025

- How Much Should You Set Aside for Emergencies?

- Smart Places to Park Your Contingency Savings

- Starting from Scratch? How to Build a Reserve with Low Income

- Emergency Savings vs. Investment Accounts

- Pitfalls to Avoid When Creating a Safety Reserve

- Real-Life Scenarios: How People Avoided Debt During Crises

- Best Tools & Apps for Monitoring and Automating Your Savings

- Final Words: Building the Foundation for True Financial Stability

- FAQs Answered for 2025

✅ 1. What’s a Financial Safety Net & Why You Need It in 2025

- An emergency fund is money set aside for sudden, unexpected expenses—such as job loss, hospital bills, urgent home or car repairs, or even a global event (like a pandemic).

- In 2025, where AI job disruptions, rising healthcare costs, and inflation are real threats, having a financial cushion is not optional—it’s essential for peace of mind.

- A financial buffer—commonly known as an emergency reserve—is a sum of money set aside exclusively for unexpected expenses. This could be anything from losing a job, a medical emergency, a vehicle breakdown, or even a global event disrupting your cash flow.

- With rising inflation, job automation through AI, and rising healthcare costs, having backup funds is no longer a luxury. It’s a non-negotiable layer of protection.

“Emergency funds are your first defense against going into debt or selling investments prematurely.”

💰 2. How Much Should You Set Aside?

While the ideal amount depends on lifestyle and income, a general rule still applies in 2025:

🔐 Save the equivalent of 3 to 6 months’ essential costs.

Example Table:

| Monthly Spend | Recommended Reserve |

|---|---|

| ₹25,000 | ₹75,000 – ₹1,50,000 |

| ₹40,000 | ₹1,20,000 – ₹2,40,000 |

| ₹60,000 | ₹1,80,000 – ₹3,60,000 |

📌 Self-employed professionals should target a 6 to 9-month buffer, due to unpredictable cash flow.

🏦 3. Smart Places to Park Your Contingency Savings

Your emergency fund should be safe, liquid (easily accessible), and separate from your daily spending account.

Accessibility and safety are key.

Best Options (India & Globally):

- High-yield savings accounts (for easy withdrawals)

- Sweep-in FDs (linked to your savings account)

- Liquid mutual funds (low risk, fast redemption)

- Flexi-fixed deposits (for better returns + liquidity)

🚫 Avoid placing this money in:

- Stock markets

- Long-term FDs

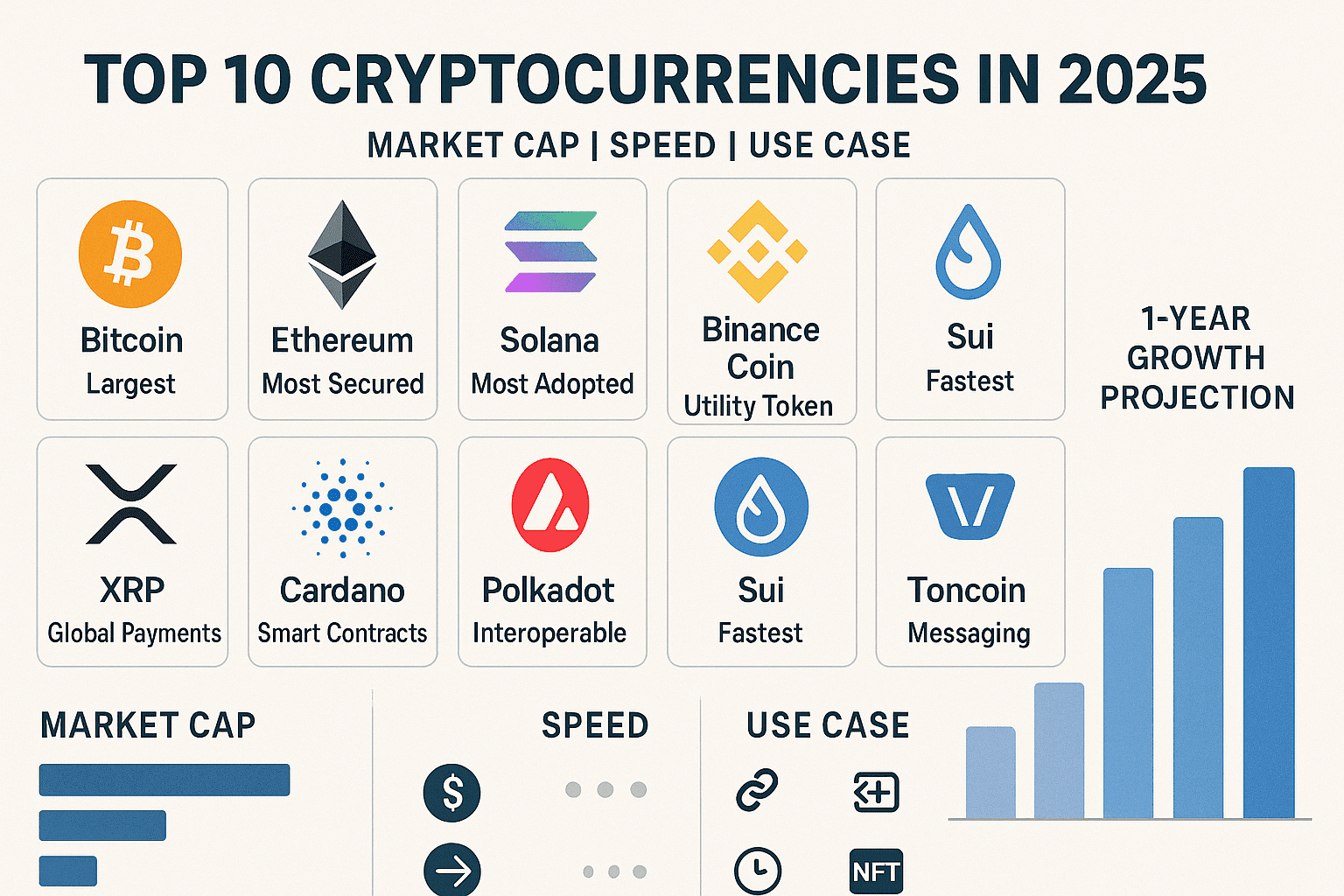

- Cryptocurrencies

- PPF or real estate

These aren’t easily liquidated when a crisis hits.

Avoid: Stocks, crypto, long-term FDs, or PPF—they’re either risky or hard to withdraw instantly.

💸 4. Starting from Scratch? Here’s a 5-Step Plan

Building a reserve is possible even with limited earnings. Here’s how to begin:

✅ Step 1: Set Micro Goals

Start with a ₹5,000 milestone. Then level up to ₹10,000, and so on.

✅ Step 2: Automate the Habit

Set recurring transfers through your banking app or create a small SIP in a low-risk liquid fund.

✅ Step 3: Eliminate One Monthly Expense

Example: Cancel one streaming platform or avoid weekly takeout. Saving ₹1,200/month adds up.

✅ Step 4: Redirect Windfalls

Cashback, tax returns, Diwali bonuses, or side gig income—allocate a fixed % (e.g., 40%) to your buffer fund.

✅ Step 5: Track Progress

Use tools like:

- Walnut or MoneyFy (for expense monitoring)

- Excel or Google Sheets

- Jupiter Money or Fi Money (auto-saving features)

📊 5. Emergency Savings vs. Investment Accounts

They serve different purposes and shouldn’t be confused.

| Feature | Safety Reserve | Investment Portfolio |

|---|---|---|

| Goal | Financial protection | Wealth growth |

| Risk | Minimal | Moderate to high |

| Liquidity | Immediate to 24 hrs | Days or weeks |

| Examples | Bank account, FDs | Stocks, mutual funds, RE |

Don’t expect your reserve to grow fast—it’s about stability, not returns.supposed to protect.

⚠️ 6. Pitfalls to Avoid When Creating Your Financial Buffer

Many well-intentioned savers stumble into these common traps:

❌ Mixing your buffer with vacation or gadget funds

❌ Putting the reserve in volatile markets

❌ Not accounting for inflation (₹50K in 2020 ≠ ₹50K in 2025)

❌ Using it for non-emergencies

🔒 Pro Tip: Label your account “Only for Real Emergencies”—it works as a mental barrier.isciplined.

🙌 7. Real-Life Examples: Proof That Buffers Work

🧍♂️ Raj from Mumbai (2020): Lost his job during the pandemic but had ₹2 lakh saved. Avoided debt and covered expenses for 4 months.

👩💻 Ananya from Hyderabad (2023): As a freelance designer, she faced a 3-month project gap. Her savings helped her manage rent and food stress-free.

👫 Couple in Pune (2024): An unexpected surgery cost ₹90,000. Their savings prevented them from redeeming long-term investments prematurely.

These stories show that a little preparation = major relief.

📱 8. Best Tools & Apps to Build & Track Your Buffer

Top Platforms in 2025:

| App/Tool | Function |

|---|---|

| Jupiter Money | Auto-save, smart reminders |

| Fi Money | Rule-based savings goals |

| Groww / FundsIndia | Invest in safe, liquid mutual funds |

| Walnut | Budgeting + smart insights |

| ETMONEY | SIP planner, bill tracker |

🔁 Use automation—set it, forget it, and watch your fund grow silently and build steadily.

🧠 9. Final Words: Start Today, Sleep Better Tomorrow

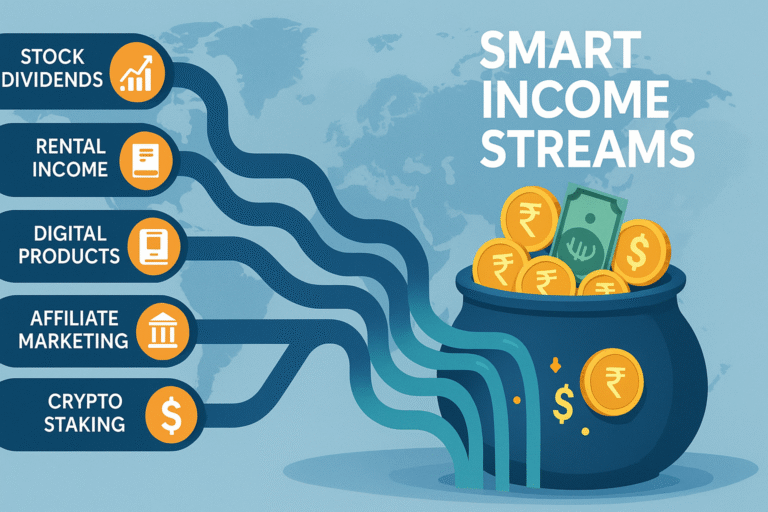

If you’re serious about money in 2025, your emergency fund is your foundation.

Before you invest, before you buy crypto, before you chase side hustles—build your safety net.

It’s not just about surviving a crisis, it’s about protecting your peace of mind and financial dignity.

You’ll never regret building an emergency fund. But you may regret not having one when you need it.

❓ 10. FAQs About Emergency Funds in 2025

Q1. Can I invest my emergency fund in mutual funds?

Only in liquid or ultra-short-term debt funds. Avoid equity-based funds.

Q2. How fast should I build an emergency fund?

Within 6–12 months. Faster if your job/income is uncertain.

Q3. Is a credit card enough as an emergency backup?

No. Credit = debt. Emergency fund = self-reliance.