Top 9 MoneySaving Hacks in 2025 That Actually Work: Save Smart & Live Better

Top 9 Money Saving Hacks in 2025 That Actually Work: Save Smart & Live Better

Discover 9 powerful money-saving hacks in 2025 that truly work for Indian and global audiences. Smart budgeting, cashback tricks, automation, and modern tools to supercharge your savings.

📌 Table of Contents

- Automate Your Savings First

- Use UPI Cashback & Reward Apps

- Switch to Subscription Trackers

- Shop During Flash Sales with Coupons

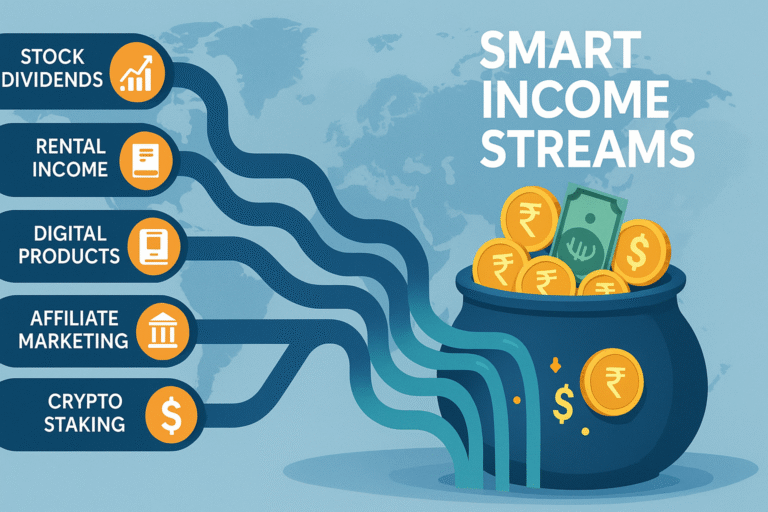

- Invest Instead of Just Saving

- Cut Hidden Fees & Charges

- Choose Smart Grocery & Meal Planning

- Optimize Your Credit Card Usage

- Leverage Tax Deductions & Exemptions

- Final Words: Save Smart, Live Better

- Internal & External DoFollow Links

💳 1. Automate Your Savings First

“Don’t save what’s left after spending. Spend what’s left after saving.” — Warren Buffet

Start 2025 right by automating your savings the moment your salary hits the bank. This creates consistent discipline and removes the temptation to overspend.

✅ Action Tip:

Use apps like INDmoney, ET Money, or your net banking to auto-transfer 20% of your income to a separate savings or liquid mutual fund account.

💸 2. Use UPI Cashback & Reward Apps

Apps like PhonePe, Paytm, GPay, and Cred offer cashback on UPI transactions, utility bills, and recharges. It might seem small, but monthly rewards can add up to ₹1,000 or more!

Bonus:

Cred coins can be exchanged for free subscriptions or discounts.

✅ Hack:

Use credit card payment apps like Cred and pay bills through Magicpin for double benefits.

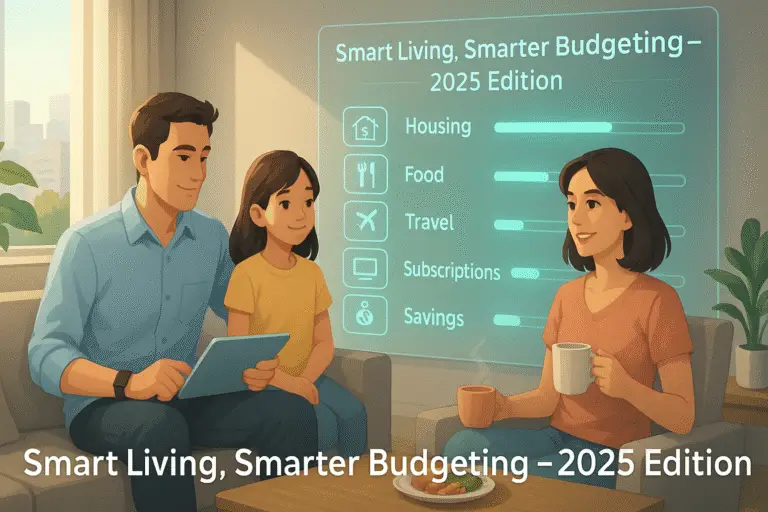

📱 3. Switch to Subscription Trackers

In 2025, most people have 5–10 subscriptions: OTT, cloud storage, SaaS tools, etc. You could be losing ₹500–₹2000/month on unused ones.

✅ Hack:

Use Truebill (USA) or Billeasy (India) to track and cancel dormant subscriptions.

Result:

You’ll recover wasted money and reassign it to more valuable financial goals.

🛒 4. Shop During Flash Sales with Coupons

Amazon, Flipkart, Meesho, and Nykaa run major sales during festivals, end-of-season, and month-end offers. Combine these with cashback cards or sites like CashKaro to stack discounts.

✅ Hack:

- Create wishlists and wait for flash sales

- Use browser plugins like Honey or GrabOn

Result:

Save 20–40% on essentials and tech gadgets.

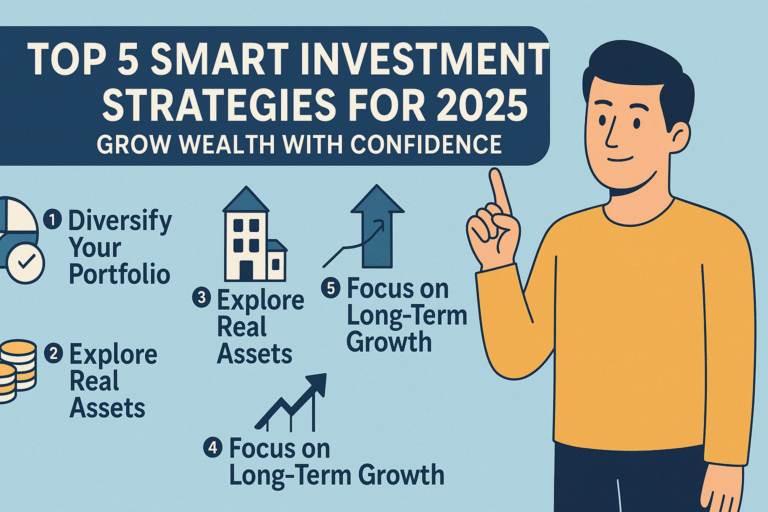

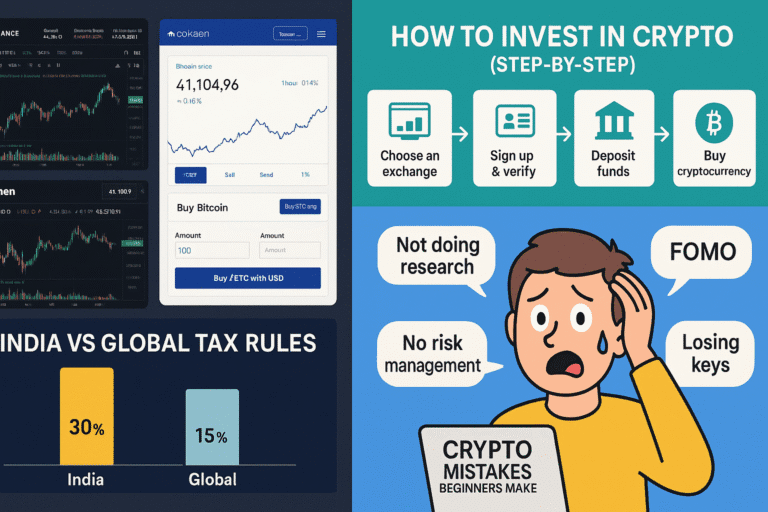

💰 5. Invest Instead of Just Saving

Saving is good. But investing smartly ensures your money grows and beats inflation.

✅ Hack:

Start SIPs in low-cost Index Funds (Nifty 50) or Debt Funds for stable returns.

- Apps: Zerodha Coin, Groww, Kuvera

- Start with as low as ₹500/month

⚠️ 6. Cut Hidden Fees & Charges

Banks, wallets, and apps charge various hidden fees like:

- SMS alerts (₹15/quarter)

- ATM withdrawal charges

- Forex markup fees (3–4%)

- Inactive credit card annual charges

✅ Hack:

- Opt for zero-balance digital banks like Jupiter, Fi

- Use Niyo Global card for free international spending

- Cancel unused cards and set auto reminders for due dates

🥗 7. Choose Smart Grocery & Meal Planning

Food is often the 2nd highest expense for Indian households. Swiggy/Zomato + unplanned groceries = financial mess.

✅ Hack:

- Plan meals weekly

- Use BigBasket Smart Basket or Dunzo Daily

- Cook bulk meals & freeze portions

Result:

Save ₹3,000–₹5,000 monthly by avoiding last-minute online food orders.

💳 8. Optimize Your Credit Card Usage

When used right, credit cards don’t trap you in debt — they boost rewards, cashback, and credit score.

✅ Hack:

- Use Axis Ace (5% cashback on bills) or HDFC Millennia

- Pay in full BEFORE due date

- Convert large payments to No Cost EMIs only when needed

Bonus:

Use reward points for flights, hotels, or shopping.

🧾 9. Leverage Tax Deductions & Exemptions

Max out your Section 80C benefits (₹1.5 lakh/year) via:

- ELSS mutual funds

- PPF (Public Provident Fund)

- Life insurance

Also claim deductions on:

- Health insurance (Sec 80D)

- Home loan interest (Sec 24b)

✅ Hack:

Use tax planning calculators on ClearTax or Quicko.

🧠 Final Words: Save Smart, Live Better

Saving money in 2025 isn’t about extreme frugality—it’s about smart strategies that multiply your wealth and reduce waste.

With the right tools, habits, and hacks, you can:

- Save ₹30,000–₹50,000 extra per year

- Stay debt-free

- Build a future-proof lifestyle

💬 “Small leaks sink great ships. Fix your leaks, grow your wealth.”