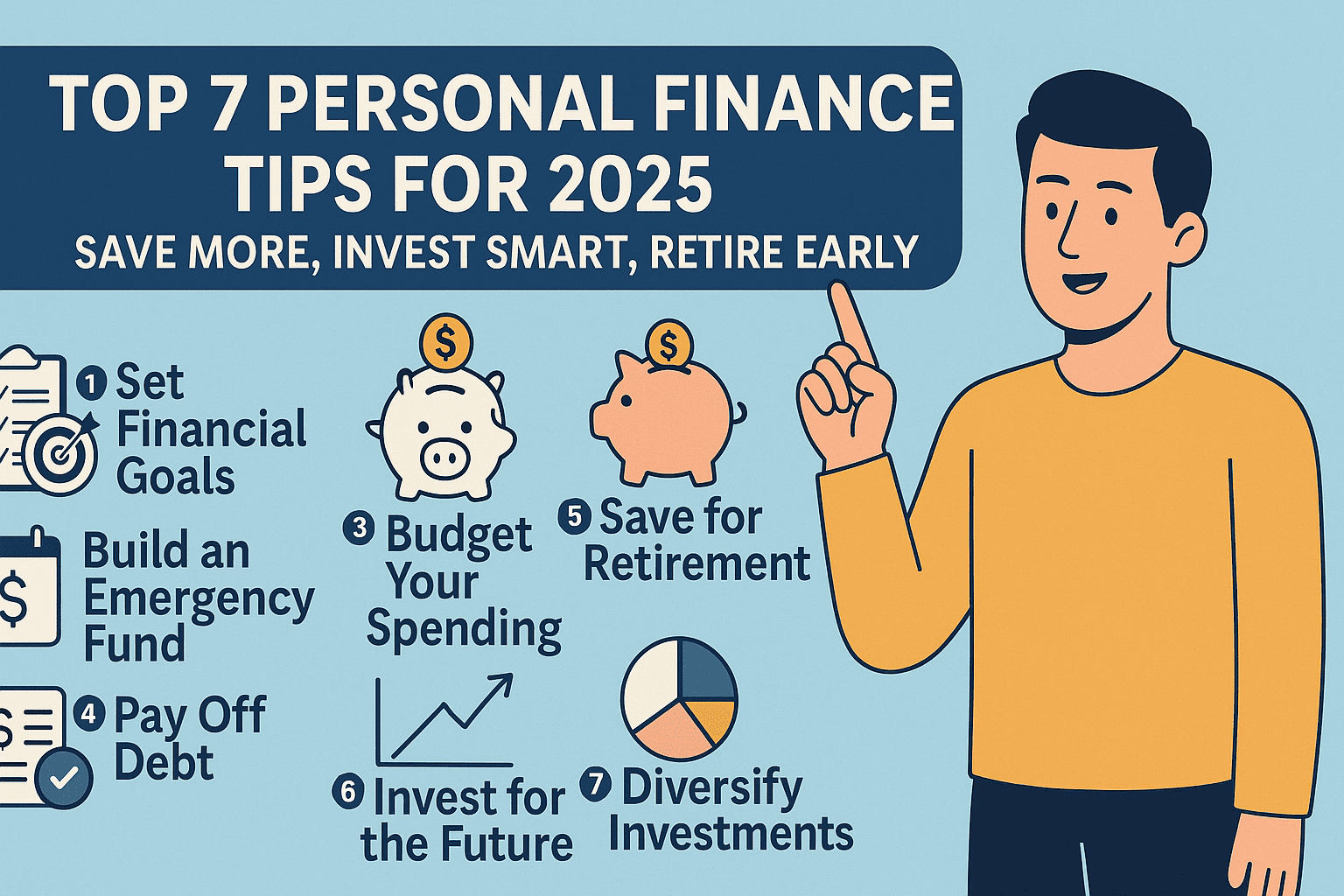

Top 5 Personal Finance Mistakes to Avoid in 2025: Stay Ahead & Grow Your Wealth

Top 5 Personal Finance Mistakes to Avoid in 2025 : Stay Ahead & Grow Your Wealth

Avoid these top 5 personal finance mistakes in 2025 to protect your future, grow your wealth, and become financially independent. This guide helps beginners and experts with real-world strategies.

📌 Table of Contents

- Spending Without a Budget

- Ignoring an Emergency Fund

- Investing Without Clear Goals

- Relying Solely on Fixed Deposits

- Not Prioritizing Financial Education

- Bonus Tips for Financial Growth

- Final Thoughts

- Internal & External DoFollow Resources

💸 1. Spending Without a Budget

Why It’s the #1 Mistake in 2025

In the age of UPI, credit cards, and one-tap purchases, spending money is easier than ever. From daily coffee orders to last-minute online shopping, untracked expenses can silently drain your income.

Without a budget, you have no control over your cash flow. Many people feel like they never have enough money, not because they don’t earn enough—but because they don’t track where it’s going.

Real Example:

Rohan, a 28-year-old software engineer in Bangalore, earns ₹1.2 lakh/month. Yet by the 20th, he’s always broke. After tracking expenses, he realized ₹18,000/month was going to online food and subscriptions!

✅ How to Fix It:

- Use apps like Walnut, MoneyView, or ET Money to track every rupee.

- Apply the 50-30-20 rule:

- 50% for needs (rent, groceries, bills)

- 30% for wants (entertainment, shopping)

- 20% for savings and investments

🚨 2. Ignoring Emergency Funds

Why This One Can Destroy Your Financial Life

Emergencies don’t come with a warning. Whether it’s job loss, a medical emergency, or sudden repairs—having zero savings can lead you to credit card debt or personal loans with high interest rates.

Even in 2025, a shocking 60% of Indians don’t have an emergency fund, according to surveys by fintech platforms.

✅ How to Fix It:

- Save 3 to 6 months of your monthly expenses in a separate savings account or liquid mutual fund.

- Automate the savings each month, even if it’s ₹2,000–₹5,000.

Recommended Tools:

- SBI Insta Savings for basic safe storage

- Groww Liquid Funds for easy withdrawal and better returns

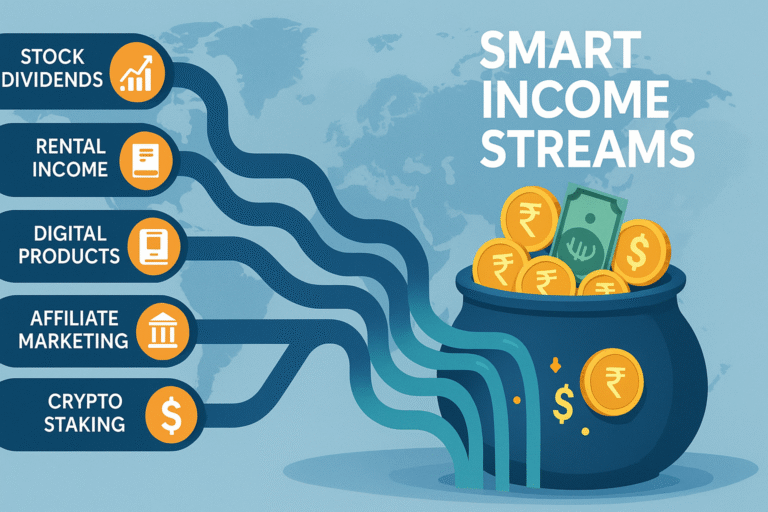

🎯 3. Investing Without Clear Goals

Why Random Investing Is a Huge Mistake

Just opening a Demat account and investing in trending stocks or mutual funds isn’t enough. Many people invest blindly—without timelines, risk understanding, or defined goals. This leads to panic selling or withdrawing funds early.

In 2025, smart investing is not just about where to invest but also why, how much, and for how long.

✅ How to Fix It:

- Define Your Financial Goals:

- Buy a car in 3 years

- Save for child’s education in 10 years

- Retire at 50

- Choose Products Based on Goals:

- <5 years: Debt Mutual Funds, FDs

- 5–10 years: Balanced Funds, Gold ETFs

- 10+ years: Equity Mutual Funds, Index Funds, NPS

Bonus Tip:

Use goal-based investing apps like INDmoney or Kuvera that allow you to assign financial goals to each SIP.

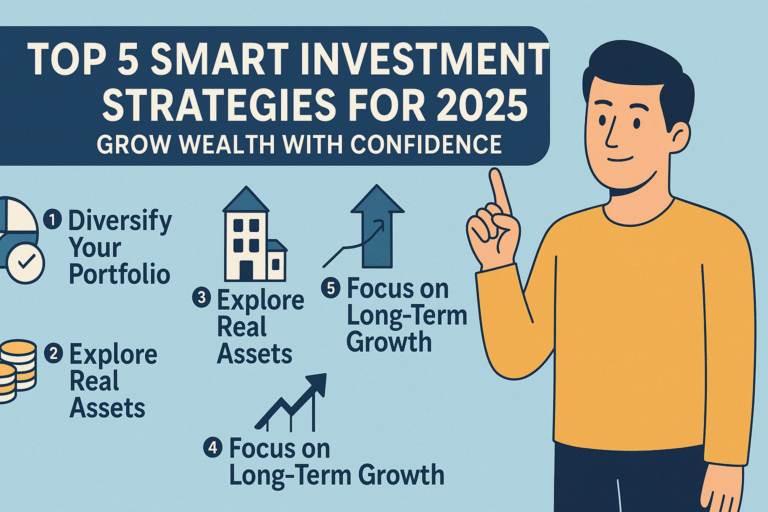

🏦 4. Relying Solely on Fixed Deposits

Why FDs Alone Won’t Make You Wealthy

Fixed deposits (FDs) are safe—but they don’t grow your wealth. In 2025, inflation is around 5-6%, while most FDs give 6.5–7.2% returns. That’s barely enough to keep up, let alone grow.

Over time, your money loses value sitting in FDs.

✅ How to Fix It:

- Diversify: Instead of keeping all your funds in FDs, allocate:

- 30% in Equity Mutual Funds

- 30% in PPF/NPS

- 20% in Gold/SGBs

- 20% in FDs or RDs

- Use bank FD ladders if you’re conservative. But don’t ignore inflation-beating assets.

Pro Tip:

Start with Index Funds (like Nifty 50) for low-cost equity exposure. They’re less volatile and great for beginners.

📚 5. Not Prioritizing Financial Education

Why Financial Illiteracy is Dangerous in 2025

People who don’t understand finance fall prey to MLM schemes, fake crypto projects, and wrong insurance policies. In India, less than 27% of adults are financially literate.

You may earn ₹1 lakh per month, but if you don’t manage or invest it properly—you’re just working harder, not smarter.

✅ How to Fix It:

- Spend 30 minutes/week learning personal finance. Follow trusted YouTubers like:

- CA Rachana Ranade

- Pranjal Kamra (Finology)

- Ankur Warikoo

- Read books like:

- Rich Dad Poor Dad

- The Psychology of Money

- Let’s Talk Money by Monika Halan

- Visit blogs like Madhav Info for real-world Indian finance insights.

🎁 Bonus Tips for Financial Growth in 2025

- Automate Your Investments: Use auto-SIP features to stay consistent.

- Use Credit Cards Smartly: Pay in full, get rewards—don’t treat it like a loan.

- Review Insurance: Ensure you have health + term life insurance in place.

- Avoid Lifestyle Inflation: As income grows, increase your investments—not your expenses.

🧠 Final Thoughts

If you avoid these top 5 personal finance mistakes in 2025, your future self will thank you. It’s not about making lakhs overnight—it’s about making consistent smart choices.

Start budgeting, save for emergencies, set investing goals, diversify your money, and keep learning.

Remember:

“Money won’t solve all your problems, but managing it right will prevent many of them.”