Top 5 Smart Investment Strategies for 2025: Grow Wealth with Confidence

Top 5 Smart Investment Strategies for 2025: Grow Wealth with Confidence

Explore the top 5 smart investment strategies for 2025 to help you grow wealth, reduce risks, and build a solid financial future. Perfect for Indian and global investors.

📑 Table of Contents

- Diversify Your Portfolio Globally

- Invest in Index Funds and ETFs

- Leverage SIPs for Long-Term Growth

- Explore Digital Assets & Tokenized Securities

- Focus on Sustainable & ESG Investments

- Bonus Tips for Smarter Investing

- Final Thoughts

1. 🌐 Diversify Your Portfolio Globally

One of the smartest investment strategies in 2025 is geographic diversification. With global economies reacting differently to macroeconomic trends like inflation, interest rate changes, and geopolitical tensions, having all your money in one country can be risky.

Investing in a mix of Indian and international stocks can smoothen volatility and increase potential returns over the long run. By spreading risk across various economies, you protect your wealth against local market crashes and currency fluctuations.

✅ Benefits:

- Protection from regional downturns

- Exposure to global innovation and sectors like AI, clean energy, and biotech

- Opportunity to earn in stronger currencies like USD or EUR

📊 Platforms to Use:

- INDmoney: Offers direct US stock investing from India

- Groww Global: Invest in top US stocks and ETFs

- Interactive Brokers: Ideal for advanced global investors

Pro Tip: Allocate 10–20% of your equity portfolio to global ETFs like the S&P 500 or Nasdaq-100 for balanced growth.

2. 📈 Invest in Index Funds and ETFs

In 2025, passive investing continues to rise. Index funds and ETFs (Exchange-Traded Funds) provide broad exposure to markets at a lower cost compared to actively managed funds. These instruments are ideal for both beginners and seasoned investors.

An index fund tracks a specific index such as the Nifty 50, Sensex, or the S&P 500. Since they don’t require active management, they often outperform expensive mutual funds in the long run.

🔍 Why It Works:

- Extremely low fees

- Broad market exposure in a single investment

- Lower risk compared to picking individual stocks

- Requires less monitoring and rebalancing

🏆 Top Picks for 2025:

- Nippon India Nifty 50 Index Fund (India)

- Motilal Oswal Nasdaq 100 ETF

- Vanguard Total World Stock ETF (VT) (Global)

“In the short run, the market is a voting machine; in the long run, it’s a weighing machine.” – Warren Buffett

3. 💸 Leverage SIPs for Long-Term Growth

Systematic Investment Plans (SIPs) continue to be one of the most trusted investment strategies for 2025, especially for salaried professionals and millennials. SIPs allow you to invest a fixed amount in mutual funds periodically, helping you build wealth through rupee cost averaging.

💡 Advantages of SIPs:

- Disciplined investing: You don’t need to time the market

- Start small: SIPs start as low as ₹500/month

- Long-term wealth creation with compounding

📊 Example Scenario:

A monthly SIP of ₹5,000 for 15 years in a fund with 12% CAGR can generate a corpus of over ₹25 lakhs.

🛠️ Best SIP Platforms:

- Zerodha Coin: Direct mutual fund investment without commission

- ET Money: Offers SIP calculator, portfolio tracking

- Groww: User-friendly and good for first-time investors

Pro Tip: Step-up your SIP every year with your salary hike for exponential returns.

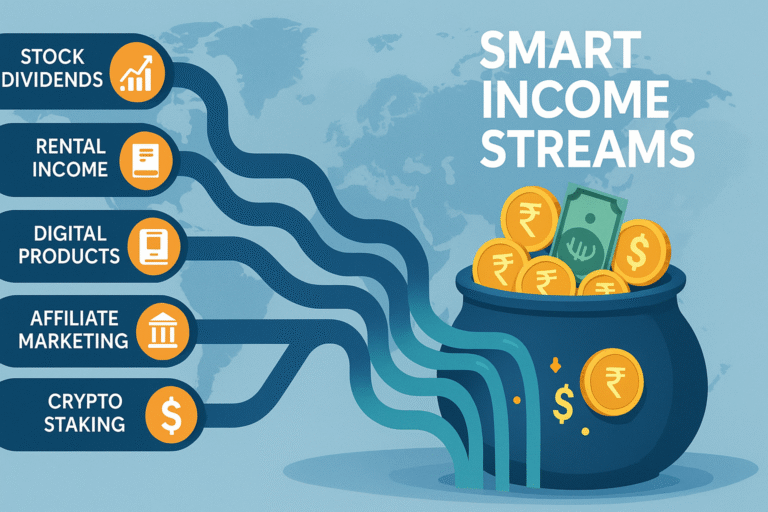

4. 🧠 Explore Digital Assets & Tokenized Securities

Digital assets are no longer a buzzword—they’re mainstream. While cryptocurrencies are still volatile, tokenized securities, digital gold, and central bank digital currencies (CBDCs) are emerging as secure digital investment options.

🔍 What to Explore in 2025:

- Digital Rupee (CBDC) by RBI for low-risk digital transactions

- Tokenized assets like US stocks, real estate, and bonds

- Crypto staking: Earn passive income via staking on trusted platforms

🔐 Security Tip: Store your crypto in hardware wallets like Ledger or Trezor. Always enable 2FA.

Top Platforms:

Diversify—but invest only what you can afford to lose in digital assets.

5. 🌱 Focus on Sustainable & ESG Investments

In 2025, investors care about profits with a purpose. Environmental, Social, and Governance (ESG) investments offer competitive returns while supporting sustainable businesses.

🌍 Why ESG is the Future:

- Aligned with global climate and sustainability goals

- More resilient during downturns

- Supported by regulatory and institutional capital

🔎 Best ESG Funds for 2025:

- Axis ESG Equity Fund (India)

- SBI Magnum ESG Fund

- iShares Global Clean Energy ETF (Global)

Pro Tip: Use Morningstar or Value Research to analyze ESG ratings before investing.

6. 💡 Bonus Tips for Smarter Investing

Besides the core strategies, here are some timeless principles that work in every market:

📌 Rebalance your portfolio every 6–12 months

📌 Always keep an emergency fund equal to 6 months’ expenses

📌 Don’t follow hype—invest with logic and research

📌 Focus on long-term goals, not short-term fluctuations

📌 Learn from reliable finance sources like Zerodha Varsity, CNBC, and Investopedia

Knowledge is the greatest compounder of all.

7. ✅ Final Thoughts: Build Wealth with Smart Moves in 2025

In a rapidly changing world, your investments must adapt too. The top 5 investment strategies for 2025 are designed to give you stability, growth, and confidence in your financial journey.

Recap of What You Learned:

- Diversify globally to reduce risk

- Use index funds and ETFs to cut costs

- Grow wealth steadily with SIPs

- Explore digital but secure your assets

- Invest ethically with ESG strategies

🎯 Whether you’re just starting or already have a portfolio, it’s time to invest smarter, not harder. Let your money work for you while you focus on life’s bigger goals.

💬 Drop a comment: Which of these strategies will you try first?

🔗 Internal & External DoFollow Links

Internal:

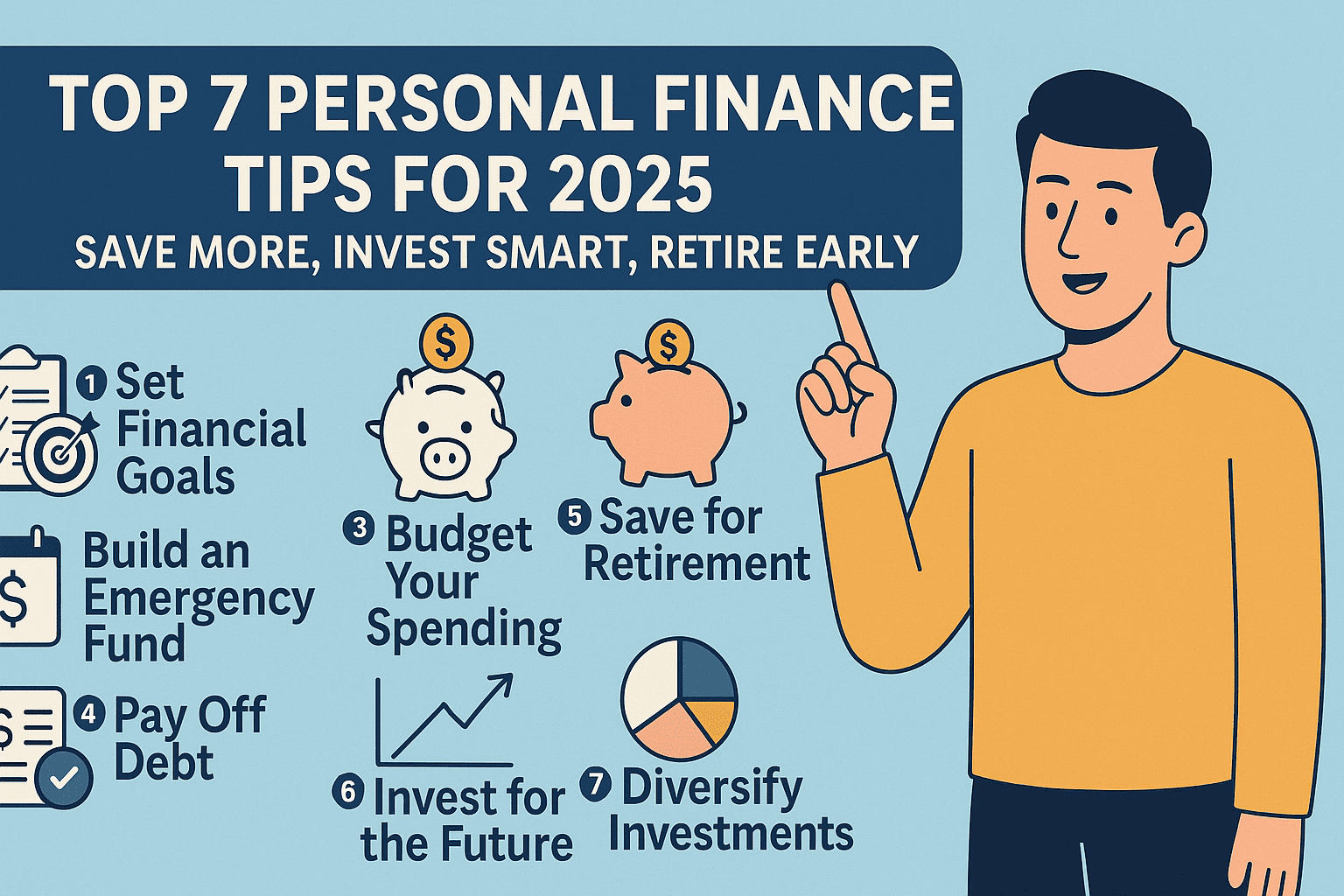

- Top 7 Personal Finance Tips for 2025

- How to Start Investing in Crypto in 2025

- Crypto vs Stock Market in 2025